Stealing, specifically reimbursement for business expenses, is an unfortunate reality for many organizations. According to the Association of Certified Fraud Examiners (ACFE), expense fraud accounts for 14.5 percent of all reported occupational scams. Fraud affects all industries. No company is immune.

2 min read

Is Your Company Vulnerable To Expense Report Fraud?

By Gibson on Apr 11, 2018 6:30:00 AM

Topics: Finance Accounting Support

4 min read

Five Common Accounting Mistakes And How To Avoid Them

By Gibson on Jan 15, 2018 6:30:00 AM

New technology and accounting software has made bookkeeping and accounting easier for small to mid-sized businesses, but it hasn’t entirely eliminated costly accounting mistakes. Some mistakes may have minimal effect to a company’s financials and can be corrected. While other mistakes are more serious and could have a significant impact by misrepresenting a company’s true financial health. In this blog, we’ll review five of the most common accounting errors and how to avoid them.

Topics: Select Business Solutions Accounting Support

3 min read

What Employers Need To Know About Holiday Gifts & Bonuses

By Gibson on Nov 27, 2017 6:30:00 AM

Giving your employees bonuses or gifts is often considered a way to spread cheer and thanks during the holiday season.

A holiday bonus could lessen employee financial stress during this busy time. But monetary gifts aren’t the only way to show your appreciation – don’t forget about personal thank you notes, celebratory events, team-building activities, time off, company swag, and more.

If you are looking to provide a holiday gift to your employees, it is important understand some of the implications these gifts may have – on you as the employer and on the individual employees.

Topics: Select Business Solutions Payroll Accounting Support

3 min read

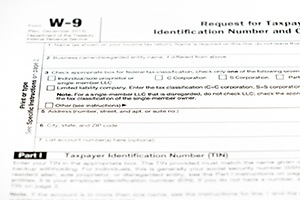

What You Need To Know About W-9s & 1099 Filing

By Gibson on Nov 13, 2017 6:30:00 AM

January 31st will be here before you know it, and with it the deadline to file 1099 tax forms. In a perfect world, this deadline is met with security and peace of mind. In the real world? Not so much. We’ve seen many companies who couldn’t tell us where W-9s were kept or if the accounting department collected them at all. If you, like many companies, dread the deadline each year, there is still time. Read below to understand best practices for filing 1099s, why obtaining and maintaining your company’s vendors’ W-9s is important, and how to prepare for success for the approaching deadline.